White Paper Series: Time to think – Gambling Commission consultation on land-based age verification measures

On 26 July 2023, the Gambling Commission opened its first consultation (the “Consultation”) following the White Paper. This included proposals to strengthen age verification in land-based premises, which we consider in this blog.

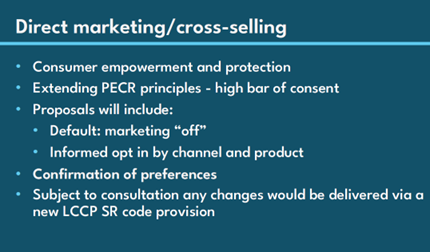

In recent White Paper Series blogs, we discussed other proposals in the Consultation including changes to game design, personal management licences and direct marketing. We strongly encourage the industry to respond to the Consultation.

Background

Test purchasing, the hiring of seemingly underage customers to attempt to buy or participate in age-restricted items or services, is a well-known measurement tool for compliance in the land-based sector. It has been a requirement since 2015 for most non-remote licensees to ensure their policies and procedures designed to prevent underage gambling are effective by undertaking test purchasing. The requirement (as set out under social responsibility code provision (“SRCP”) 3.2) encompasses all casinos, betting premises, adult gaming centres (“AGCs”), licensed family entertainment centres (“FECs”) and bingo premises that fall within fee category C or higher. In other words, smaller operators (in fee category A or B) are currently exempt.

The Government was clear in the White Paper that it was concerned about poor test purchasing pass rates for some gambling premises. Noting the poor test purchasing results for on-course bookmakers and alcohol licensed premises in particular, the Government emphasised:

“We challenge these industries to take further measures to urgently improve age verification measures, including by obtaining commercial verification of increased pass rates. We will continue to monitor industry’s progress on this issue and will legislate to make provisions within the Gambling Commission’s code of practice for alcohol licensed premises binding when Parliamentary time allows.”

The Gambling Commission’s most recent comparative data on the test purchasing performance of licensed gambling venues highlights the following pass rates:

- Casino: 98%

- Betting: 87%

- Bingo: 83%

- AGCs: 80%

Whilst these pass rates compare well to pass rates in the liquor industry, the exemption for smaller operators leads to “an incomplete picture of risk from underage gambling in those premises.” To “strengthen age verification testing and assurance in premises”, the Consultation proposes to extend AV requirements to small operators so that it applies to all licensees, which is very much supported by Government.

Consultation proposals

Issue 1: Test purchasing by all licensees

The Gambling Commission acknowledges that the gambling sector is performing well at testing purchasing as a whole, but notes that “he risks to children who play underage do not differ depending on the size of the licensee.”

Due to the exemption for licensees in fee categories A and B, approximately 20% of premises are not covered by test purchasing requirements (although the Gambling Commission notes that some operators in these fee categories will participate in test purchasing through trade body membership). The Gambling Commission states that less than 20% of category A licensees and less than 50% of category B licensees had submitted test purchasing results by the requested deadline for 2022-23.

The Gambling Commission considers the “relatively low” cost of testing (can be well under £50) is a reasonable expense in a sector where licensees’ products are age restricted. Therefore, and with the above data in mind, the Gambling Commission is spurred to rectify the “‘gap’ in this picture of risk” and remove the test purchasing exemption within the LCCP for the non-remote licensees in fee categories A and B.

Issue 2: Replacing Think 21 with Think 25 as good practice for non-remote licensees

In addition to strengthening the test purchasing requirements, the Gambling Commission is considering updating the ordinary code provisions (“OCP”) for all non-remote casino, AGC, bingo and FEC and betting licensees to replace Think 21 with Think 25. This would reflect the Challenge 25 retailing strategy introduced by the Retail of Alcohol Standards Group to encourage anyone who is over the age of 18 but looks under 25 to carry acceptable ID if they wish to purchase alcohol. The Gambling Commission previously consulted on replacing Think 21 with Think 25 in 2015, noting the retention of Think 21 was dependent on the industry “continuing to deliver improvements in their ability prevent access to gambling by children and young persons…”

Primarily, the Gambling Commission’s current concerns stem from data indicating that 18% of AGCs and 16% of bingo premises did not challenge age verification test purchasers at any point (although it should be noted the Gambling Commission does not point directly to a specific dataset or figure in the Consultation). The Consultation also acknowledges calls from both industry and campaign groups to introduce Think 25 as standard for all gambling in premises, noting the position was shared by the Advisory Board for Safer Gambling in its 2018 report and echoed by the Government in the White Paper.

Issue 3: Improving the effectiveness of age verification in premises that are not directly supervised

Lastly, the Gambling Commission is seeking industry views and evidence on how licensees ensure their age verification procedures and controls are effective in premises that may not be directly supervised, such as AGCs in service stations.

Responding to the Consultation

The Consultation is open for 12 weeks, until 18 October 2023. Responses can be submitted through the Gambling Commission’s online survey, or sent by post to the Policy Team at the following address: Gambling Commission, 4th Floor, Victoria Square House, Birmingham, B2 4BP. Additionally, the Gambling Commission remains open to direct engagement with stakeholders during this period through existing meetings, networks and fora.

We strongly encourage all licensees and stakeholders to consider the impact of the Gambling Commission’s proposals at Issues 1 and 2, and to make evidence-based submissions for all three issues.

Please get in touch with us if you would like assistance with preparing a response to the Consultation or the DCMS consultations.